ARCHIVED - Canada Border Services Agency Quarterly Financial Report

For the quarter ended September 30, 2015 (Revised)

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please contact us to request a format other than those available.

Erratum

Date: December 30, 2015

Location: Table 2: Departmental Budgetary Expenditures by Standard Object (Unaudited), fiscal year 2015-2016, Standard Object – Personnel

Revision: “Personnel $339,915 thousands” replaces “Personnel $399,915 thousands”.

Rationale for the revision: Transcription error occurred during the Hyper Text Markup Language (HTML) conversion process, thus not reflecting the Chief Financial Officer and the Deputy Head approved document.

1. Introduction

This quarterly financial report (QFR) has been prepared as required by section 65.1 of the Financial Administration Act and in the form and manner prescribed by the Treasury Board. This quarterly report should be read in conjunction with the Main Estimates, Supplementary Estimates A, Canada's Economic Action Plan 2014 (Budget 2014) and Canada's Economic Action Plan 2015 (Budget 2015).

A summary description of the Canada Border Services Agency (CBSA) program activities can be found in Part II of the Main Estimates, and a detailed description in Part III – Report on Plans and Priorities.

1.1 Basis of Presentation

This QFR has been prepared using an expenditure basis of accounting. The accompanying Statement of Authorities (Table 1) includes the CBSA's spending authorities granted by Parliament and those used by the Agency, consistent with the 2014-2015 and 2015-2016 Main Estimates and Supplementary Estimates A.

Parliamentary spending authority is required before monies can be spent by the Government. Approvals are given in the form of approved limits through appropriation acts or through other legislation providing statutory spending authority for specific purposes.

When Parliament is dissolved for the purposes of a general election, section 30 of the Financial Administration Act authorizes the Governor General, under certain conditions, to issue a special warrant authorizing the Government to withdraw funds from the Consolidated Revenue Fund. A special warrant is deemed to be an appropriation for the fiscal year in which it is issued.

The CBSA uses the full accrual method of accounting to prepare and present its annual departmental financial statements that are part of the departmental performance reporting process. However, the spending authorities voted by Parliament remain on an expenditure basis.

The QFR has not been subjected to an external audit or review.

1.2 Financial Structure

The CBSA has a financial structure composed of voted budgetary authorities that include Vote 1 Operating Expenditures and Vote 5 Capital Expenditures, and statutory authorities that consist mainly of contributions to the employee benefit plans.

In addition, the Agency has the authority from Parliament to expend certain revenues that it receives in a fiscal year through the conduct of its operations to offset expenditures that it incurs in that fiscal year. As a result of this respendable authority, some of the Agency's programs are partially funded through User Fees (e.g., Nexus).

The CBSA currently operates on the basis of a two-year appropriation, whereby any unused spending authority at the end of a fiscal year is available to be used the following year. Any portion of the spending authority not used at the end of the second year is lapsed. However, effective 2016-2017, the CBSA will transition to a standard one-year appropriation in order to create a unified appropriations framework for federal departments and agencies.

2. Highlights of Fiscal Quarter and Fiscal Year-to-Date (YTD) Results

This section highlights the significant items that contributed to the net increase or decrease in resources available for the year and actual expenditures as of the quarter ended September 30, 2015.

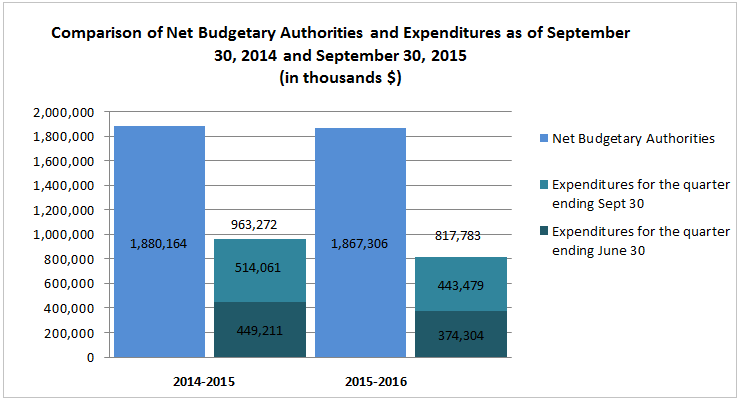

Graph 1

| 2014–2015 | 2015–2016 | |||

|---|---|---|---|---|

| Net Budgetary Authorities | 1,880,164 | 1,867,306 | ||

| Expenditures for the quarter ending Sept 30 | 514,061 | 443,479 | ||

| Expenditures for the quarter ending June 30 | 449,211 | 374,304 | ||

| Totals | 1,880,164 | 963,272 | 1,867,306 | 817,783 |

The Net Budgetary Authorities are net of Vote Netted Revenue

2.1 Significant Changes to Authorities

For the period ending September 30, 2015, the authorities provided to the CBSA are comprised of the Main Estimates, the Supplementary Estimates A and any unused spending authorities from 2014-2015 carried forward to 2015-2016. For the same period the last fiscal year, only Main Estimates 2013-2014 and the unused spending authorities were included, the Agency did not require any funding through Supplementary Estimates A.

The Statement of Authorities (Table 1) presents a net decrease of $12.9 million or 0.7% in the Agency's total authorities of $1,867.3 million at September 30, 2015 compared to $1,880.2 million total authorities at the same quarter last year. The net result is mainly due to a decrease of $67.8 million in authorities due to the decrease in the unused spending authority from the previous year ($76.0 million in 2014-2015 vs $143.8 million in 2013-2014) offset by an increase of $37.8 million as highlighted in the 2015-2016 Main Estimates and an increase of $17.1 million in the Supplementary Estimates A.

Vote 1 – Operating

The Agency's Vote 1 Operating decreased by $30.0 million or 2.0%, which is mainly attributed to the net effect of the following significant items:

Increases totaling $59.4 million as described in the CBSA Quarterly Financial Report for the quarter ended June 30, 2015;

Decreases totaling $89.4 million mainly due to:

- Decrease of $45.2 million due to a smaller carry forward of unused spending authorities. $48.4 million of unused spending authorities at the end of 2014-2015 were carried into 2015-2016 as compared to $93.6 million of unused spending authorities from 2013-14 carried forward into 2014-2015; and

- Decreases totaling $44.2 million as described in the CBSA Quarterly Financial Report for the quarter ended June 30, 2015;

Vote 5 - Capital

The Agency's Vote 5 Capital increased by $11.1 million or 5.2%, which is mainly attributed to the net effect of the following significant items:

Increases totaling $74.8 million as described in the CBSA Quarterly Financial Report for the quarter ended June 30, 2015;

Decreases totaling $63.7 million due to reduction in project funding of specific initiative:

- Decreases totaling $41.1 million as described in the CBSA Quarterly Financial Report for the quarter ended June 30, 2015;

- Decrease of $22.6 million due to a smaller carry forward of unused spending authorities. $27.6 million of unused spending authorities at the end of 2014-2015 were carried into 2015-2016 as compared to $50.2 million of unused spending authorities from 2013-2014 carried forward into 2014‑2015.

Budgetary Statutory Authorities

The Agency's Statutory Authority related to the employee benefit plan increased by $6.0 million, or 3.4% from the previous year.

2.2 Explanations of Significant Variances in Expenditures from Previous Year

As indicated in the Statement of Authorities (Table 1), the Agency's expenditures for the quarter ending September 30, 2015 was $443.5 million, as compared to $514.1 million for the quarter ending September 30, 2014. The Agency's year-to-date expenditures total $817.8 million as compared to $963.3 million at the same time last year. The decrease of $145.5 million in expenditures is mostly due to the following items.

- The Vote 1 Operating Expenditures year-to-date used at quarter end decreased by $146.7 million or 17.7%. Total expenditures of $679.9 million compared to $826.6 million last year. The bulk of the difference in spending is attributed to the severance payouts reimbursed in 2014-2015 as a result of the signed collective agreement for Border Services Officers (FB classification) for a total of $140.3 million and the payment for the Government of Canada's one-time transitional payment made in 2014-2015 for the pay-in-arrears in the amount of $38.0 million. The difference is offset by increases in other expenditures.

- The Vote 5 Capital Expenditures year-to-date used at quarter end decreased by $1.9 million or 4.0%. Total expenditure of $46.2 million as compared to $48.1 million last year. The decrease is primarily due to a decrease in salary spending under Vote 5 Capital Expenditures.

The Departmental Budgetary Expenditures by Standard Object (Table 2) the following most notable variances by standard object:

- A net decrease of $120.7 million year-to-date in personnel expenditures mainly due to severance payouts as a result of the signed collective agreement for Border Services Officers (FB classification) in 2014-2015; and

- A decrease of $38.0 million year-to-date in other subsidies and payments mainly due to the one-time transition payment for implementing salary payment in arrears by the Government of Canada in 2014-2015.

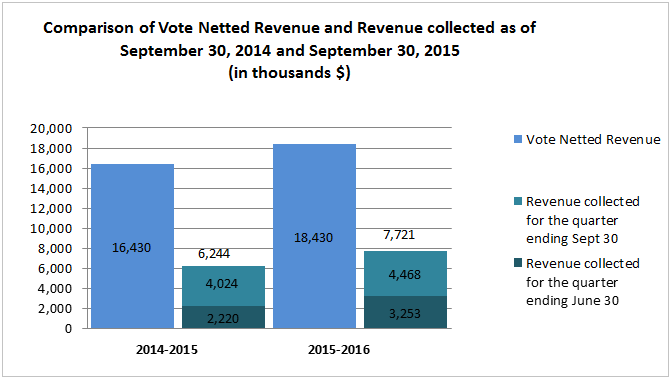

The planned revenue from the sales of services reflects the Agency's revenue respending authority and it was increased in 2015-2016 by $2.0 million or 12.2% largely due to anticipated volume increases related to programs such as Nexus. The year-to-date revenue from the sales of services is up by $1.5 million or 23.7% due to the timing in the collection of payments and volume increases in the Nexus program.

Graph 2

| 2014–2015 | 2015–2016 | |||

|---|---|---|---|---|

| Vote Netted Revenue | 16,430 | 18,430 | ||

| Revenue collected for the quarter ending Sept 30 | 4,024 | 4,468 | ||

| Revenue collected for the quarter ending June 30 | 2,220 | 3,253 | ||

| Totals | 16,430 | 6,244 | 18,430 | 7,721 |

3. Risks and Uncertainties

The complexity of the operating environment of the CBSA can be seen in the broad scope of external drivers. Developments in geopolitical relations, in the global economy, in environmental matters, and in human and animal health cascade down into Canada's trade, immigration, tourism and refugee patterns, affecting volumes and introducing security and facilitation challenges. Continued growth in both global trade and the virtual economy has benefitted legitimate business and criminal enterprises alike, and presents more complexity in managing Canada's supply chain and physical borders.

In considering these factors, the CBSA has embarked on various initiatives, including those identified in the Beyond the Border Action Plan, that will allow the organization to be even more effective in the way it does business through increased efforts to address security threats early and facilitate trade and travel.

To improve its ability to successfully deliver on its initiatives, the Agency regularly examines its enterprise risk landscape, the results of which are published in the CBSA Enterprise Risk Profile (ERP). The ERP identifies and ranks the top risks to the Agency's strategic outcome.

The Agency's top three external business risks, as evaluated by senior management and found in the CBSA Enterprise Risk Profile are the following:

- Food, Plant and Animal (FPA) - The speed and ease with which travel and trade move around the globe has increased Canada's vulnerability to FPA-related threats. The economic and ecological impacts resulting from the introduction of dangerous FPA commodities to Canada could be considerable;

- Contraband - Over the past two decades, organized crime such as drug and currency trafficking, and the illegal movement of firearms, tobacco and vehicles has become increasingly sophisticated and presents enforcement complexity as it reaches beyond national jurisdictions. Ongoing collaboration with law enforcement partners, the use of automated targeting systems, and the work accomplished by a variety of enforcement teams are examples of ways the Agency controls its exposure to the Contraband risk; and

- Terrorist Activities - Terrorism is recognized as a national security threat as Canada has been identified as a target by certain extremist groups. There is a constant need for vigilance and the Agency is continuing to mitigate the risk as the occurrence of a terrorist act either in, or associated with Canada, could have significant impacts.

4. Significant Changes in Relation to Operations, Personnel and Programs

4.1 Key Senior Personnel

There have been no changes to key senior personnel in the second quarter of 2015-2016.

4.2 Operations

The Agency continues to pursue its Border Modernization agenda, including the implementation of its Beyond the Border Action Plan projects and its engagement with employees and stakeholders on the application of the guiding principles of Blueprint 2020. In addition to these, CBSA will receive funding to replace up to 77 ports of entry across Canada.

The CBSA is also receiving funding for expanding Biometrics Screening in Canada Immigration System. This investment will see the introduction of new kiosk technology at Canada's major airports that will enhance border management and immigration security. Additional resources were also proposed to augment CBSA capacity to work with its security and law-enforcement partners to identify and interdict high-risk travellers.

4.3 New Programs

There have been no significant changes in relation to programs. The CBSA will continue to review its systems and processes to ensure a stable transition towards a single-year appropriation model. The CBSA will transition to a standard one-year appropriation in 2016-2017 in order to create a unified appropriations framework for federal departments and agencies.

5. Approval by Senior Officials

Approved by:

Linda Lizotte-MacPherson

President

Ottawa, Canada

Date: November 13, 2015

Christine Walker,

Chief Financial Officer

Ottawa, Canada

Date: November 12, 2015

6. Table 1: Statement of Authorities (Unaudited)

| Total available for use for the year ending March 31, 2016* | Used during the quarter ended September 30, 2015 | Year-to-date used at quarter end | |

|---|---|---|---|

| Vote 1 - Operating Expenditures | 1,461,506 | 363,793 | 679,945 |

| Vote 5 - Capital Expenditures | 223,192 | 33,817 | 46,218 |

| Statutory Authority - Contributions to employee benefit plans | 182,608 | 45,652 | 91,304 |

| Statutory Authority - Refunds of amounts credited to revenues in previous years | 0 | 3 | 8 |

| Statutory Authority - Spending of proceeds from the disposal of surplus Crown assets | 0 | 214 | 308 |

| Total budgetary authorities | 1,867,306 | 443,479 | 817,783 |

| Non-budgetary authorities | 0 | 0 | 0 |

| Total authorities | 1,867,306 | 443,479 | 817,783 |

Note: Numbers may not add and may not agree with details provided elsewhere due to rounding.

* Includes only Authorities available for use and granted by Parliament at quarter end.

| Total available for use for the year ending March 31, 2015* | Used during the quarter ended September 30, 2014 | Year-to-date used at quarter end | |

|---|---|---|---|

| Vote 1 - Operating Expenditures | 1,491,492 | 431,328 | 826,589 |

| Vote 5 - Capital Expenditures | 212,102 | 38,394 | 48,119 |

| Statutory Authority - Contributions to employee benefit plans | 176,570 | 44,143 | 88,285 |

| Statutory Authority - Refunds of amounts credited to revenues in previous years | 0 | 96 | 137 |

| Statutory Authority - Spending of proceeds from the disposal of surplus Crown assets | 0 | 100 | 142 |

| Total budgetary authorities | 1,880,164 | 514,061 | 963,272 |

| Non-budgetary authorities | 0 | 0 | 0 |

| Total authorities | 1,880,164 | 514,061 | 963,272 |

Note:Numbers may not add and may not agree with details provided elsewhere due to rounding.

* Includes only Authorities available for use and granted by Parliament at quarter end.

7. Table 2: Departmental Budgetary Expenditures by Standard Object (Unaudited)

| Planned expenditures for the year ending March 31, 2016 * | Expended during the quarter ended September 30, 2015 | Year-to-date used at quarter end |

|

|---|---|---|---|

| Expenditures | |||

Personnel |

1,269,562 | 339,915 | 658,929 |

Transportation and communications |

61,514 | 10,195 | 17,186 |

Information |

1,846 | 164 | 271 |

Professional and special services |

278,074 | 69,835 | 110,258 |

Rentals |

11,356 | 2,038 | 2,648 |

Repair and maintenance |

25,741 | 4,615 | 6,542 |

Utilities, materials and supplies |

21,722 | 2,701 | 5,252 |

Acquisition of land, buildings and works |

123,333 | 8,499 | 11,405 |

Acquisition of machinery and equipment |

80,432 | 7,709 | 9,443 |

Transfer payments |

- | - | - |

Other subsidies and payments |

12,156 | 2,273 | 3,562 |

| Total gross budgetary | 1,885,736 | 447,944 | 825,496 |

| Less revenues netted against expenditures | |||

Sales of Services |

18,430 | 4,468 | 7,721 |

Other Revenue |

0 | -3 | -8 |

| Total revenues netted against expenditures | 18,430 | 4,465 | 7,713 |

| Total net budgetary expenditures | 1,867,306 | 443,479 | 817,783 |

Note: Numbers may not add and may not agree with details provided elsewhere due to rounding.

* Includes only Authorities available for use and granted by parliament at quarter-end.

| Planned expenditures for the year ending March 31, 2015 * | Expended during the quarter ended September 30, 2014 | Year-to-date used at quarter end | |

|---|---|---|---|

| Expenditures | |||

Personnel |

1,247,346 | 422,120 | 779,604 |

Transportation and communications |

67,365 | 12,049 | 19,304 |

Information |

1,823 | 275 | 614 |

Professional and special services |

285,818 | 60,366 | 98,961 |

Rentals |

27,089 | 2,681 | 4,411 |

Repair and maintenance |

28,926 | 3,380 | 6,541 |

Utilities, materials and supplies |

24,557 | 3,295 | 5,547 |

Acquisition of land, buildings and works |

55,724 | 4,048 | 5,618 |

Acquisition of machinery and equipment |

139,923 | 6,724 | 7,092 |

Transfer payments |

0 | 0 | 0 |

Other subsidies and payments |

18,023 | 3,051 | 41,687 |

| Total gross budgetary expenditures | 1,896,594 | 517,989 | 969,379 |

| Less revenues netted against expenditures | |||

Sales of Services |

16,430 | 4,024 | 6,244 |

Other Revenue |

0 | -96 | -137 |

| Total revenues netted against expenditures | 16,430 | 3,928 | 6,107 |

| Total net budgetary expenditures | 1,880,164 | 514,061 | 963,272 |

Note: Numbers may not add and may not agree with details provided elsewhere due to rounding.

* Includes only Authorities available for use and granted by Parliament at quarter-end.

- Date modified: